Today we are going to talk about an important document called Form W-2. If you are wondering what it is, don’t worry, we will explain everything in a simple and easy-to-understand manner.

What is Form W-2?

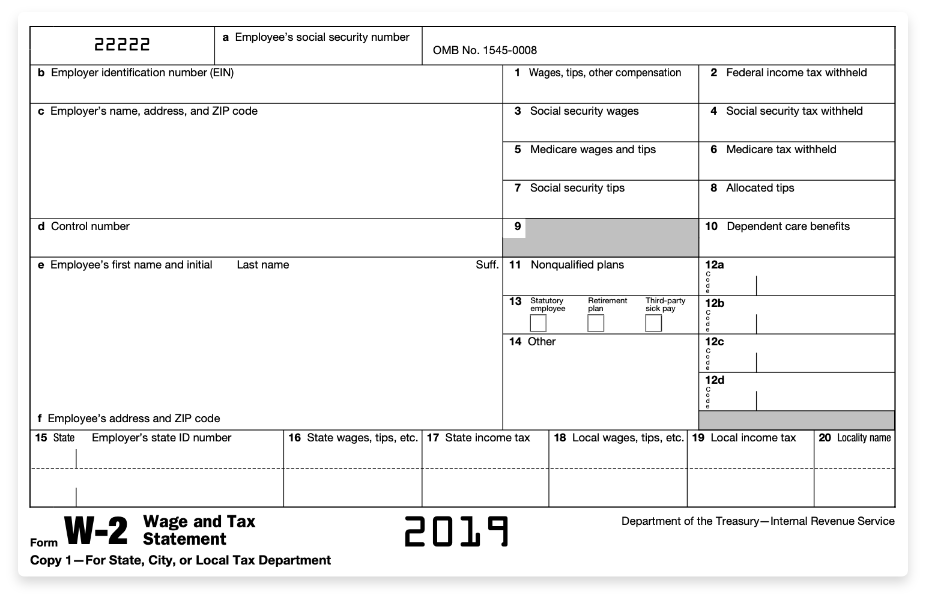

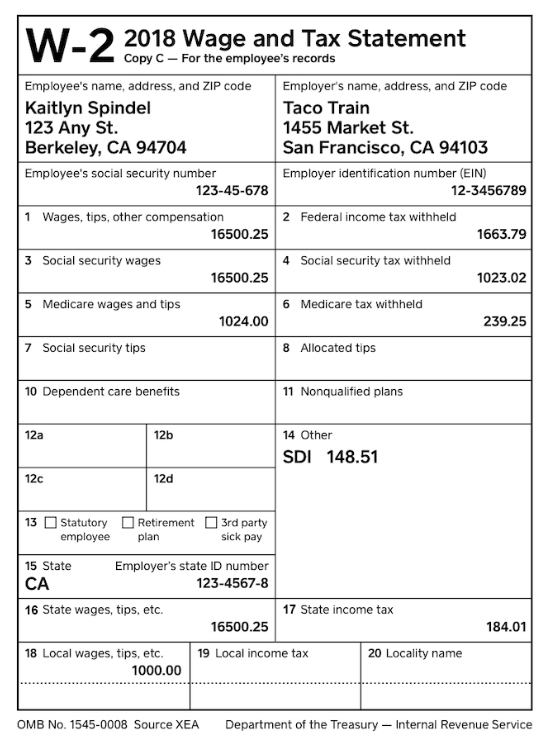

Form W-2, also known as the Wage and Tax Statement, is a document that employers are required to provide to their employees at the end of each year. It contains important information about the employee’s wages, tips, and other compensation, as well as the taxes withheld from their pay.

For the year 2020, employers had to use specific forms and guidelines to prepare and file their employees’ W-2 forms with the Internal Revenue Service (IRS). The IRS provides detailed instructions on how to fill out each section of the form, ensuring accuracy and compliance with tax regulations.

For the year 2020, employers had to use specific forms and guidelines to prepare and file their employees’ W-2 forms with the Internal Revenue Service (IRS). The IRS provides detailed instructions on how to fill out each section of the form, ensuring accuracy and compliance with tax regulations.

Why is Form W-2 important?

Form W-2 is crucial for both employees and the IRS. It serves as a record of an employee’s income for the year and helps ensure that they have paid the correct amount of taxes. Additionally, the IRS uses the information provided on the W-2 forms to cross-check with individuals’ tax returns to detect any discrepancies or potential tax fraud.

Form W-2 is crucial for both employees and the IRS. It serves as a record of an employee’s income for the year and helps ensure that they have paid the correct amount of taxes. Additionally, the IRS uses the information provided on the W-2 forms to cross-check with individuals’ tax returns to detect any discrepancies or potential tax fraud.

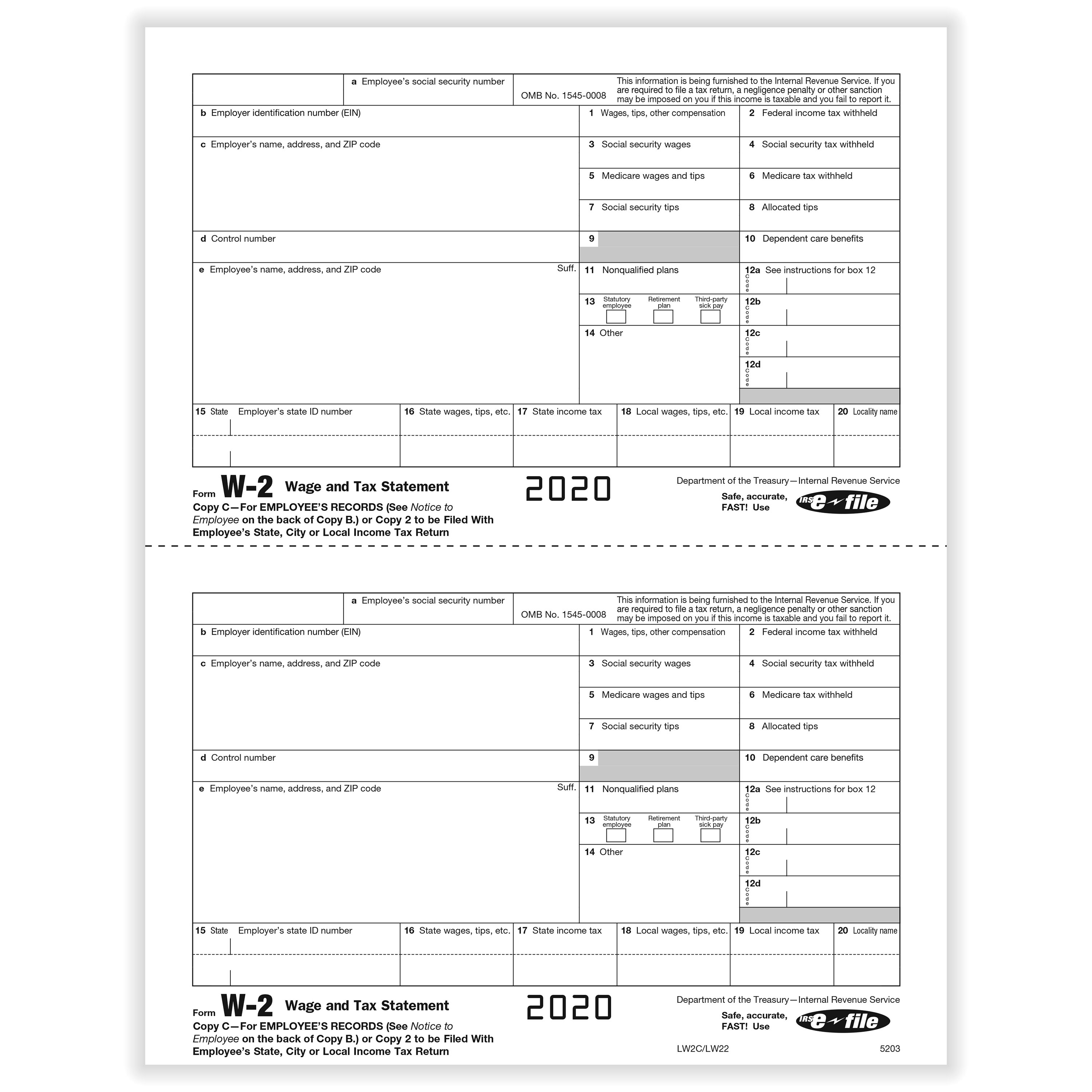

How to obtain a printable W-2 form?

If you need a printable version of the W-2 form, there are several resources available online. These websites offer free templates that you can download and fill out:

- Calendar Printables Free Blank: This website provides a downloadable and printable W-2 form for the year 2020. You can easily fill in your information and print it for your records.

- NewFreePrintable.net: Another website that offers a printable W-2 form for the year 2020. Simply download the form, fill it out, and keep a copy for your records.

Remember, it is essential to accurately fill out your W-2 form to avoid any issues with the IRS or potential discrepancies between your reported income and the information provided by your employer.

Remember, it is essential to accurately fill out your W-2 form to avoid any issues with the IRS or potential discrepancies between your reported income and the information provided by your employer.

Completing the W-2 form

When completing your W-2 form, you will need to provide the following information:

- Your personal details, such as your name, address, and Social Security number.

- Your employer’s information, including their name, address, and Employer Identification Number (EIN).

- Details of your wages, tips, and other compensation received during the year.

- The amount of federal, state, and local taxes withheld from your paycheck.

Make sure to double-check all the information before submitting the form to your employer or the IRS. Any mistakes or inaccuracies could lead to delays in tax processing or potential penalties.

Make sure to double-check all the information before submitting the form to your employer or the IRS. Any mistakes or inaccuracies could lead to delays in tax processing or potential penalties.

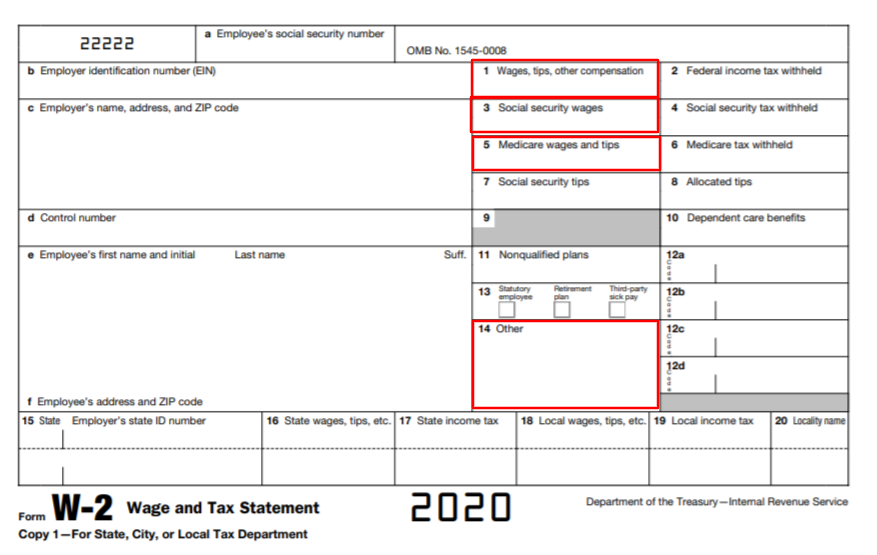

Understanding your W-2 form

It’s essential to understand the information on your W-2 form, as it can help you accurately file your taxes. The form consists of various boxes, each containing specific information:

- Box 1: Wages, tips, and other compensation.

- Box 3: Social Security wages.

- Box 5: Medicare wages and tips.

- Box 18: Local wages, tips, and other compensation.

These are just a few examples of the boxes on the W-2 form. Each box corresponds to a specific tax-related item, and it’s crucial to understand what each one represents to ensure the accuracy of your tax return.

These are just a few examples of the boxes on the W-2 form. Each box corresponds to a specific tax-related item, and it’s crucial to understand what each one represents to ensure the accuracy of your tax return.

Importance of keeping your W-2 form

Keeping a copy of your W-2 form is vital for future reference. In case you need to apply for loans, mortgages, or government assistance programs, having your W-2 form readily available can speed up the process.

Keeping a copy of your W-2 form is vital for future reference. In case you need to apply for loans, mortgages, or government assistance programs, having your W-2 form readily available can speed up the process.

Additionally, it’s a good practice to retain copies of your past W-2 forms as part of your personal tax records. These records can be helpful when filing your taxes in the future or if any discrepancies arise.

In conclusion

Form W-2 is an essential document that provides detailed information about an employee’s income and tax withholdings. It is crucial to accurately fill out and understand the W-2 form to ensure compliance with tax regulations and avoid any issues with the IRS.

Remember to consult the IRS guidelines or seek professional advice if you have any doubts or questions when preparing your W-2 form. By doing so, you can ensure that your taxes are filed correctly and avoid any potential penalties or consequences.

Remember to consult the IRS guidelines or seek professional advice if you have any doubts or questions when preparing your W-2 form. By doing so, you can ensure that your taxes are filed correctly and avoid any potential penalties or consequences.

So, make sure to keep your W-2 form safe and don’t forget to file your taxes on time!

Disclaimer: This post provides general information about Form W-2. For specific guidance regarding your individual circumstances, please consult a tax professional or the IRS website.

Disclaimer: This post provides general information about Form W-2. For specific guidance regarding your individual circumstances, please consult a tax professional or the IRS website.