The beginning of 2020 marked the release of a series of important tax forms that caught the attention of individuals and employers alike. One such form that garnered significant interest was the W-4 form. Designed to determine an employee’s federal income tax withholding, the W-4 form had several iterations in 2020, each with its own set of guidelines and instructions.

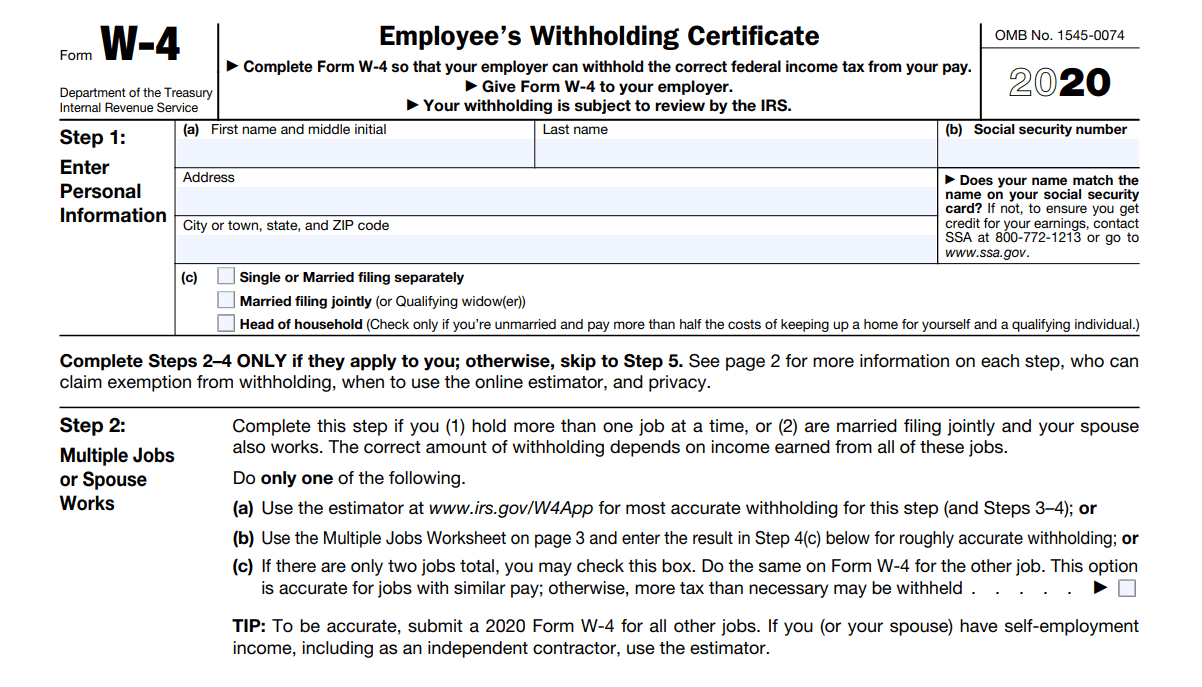

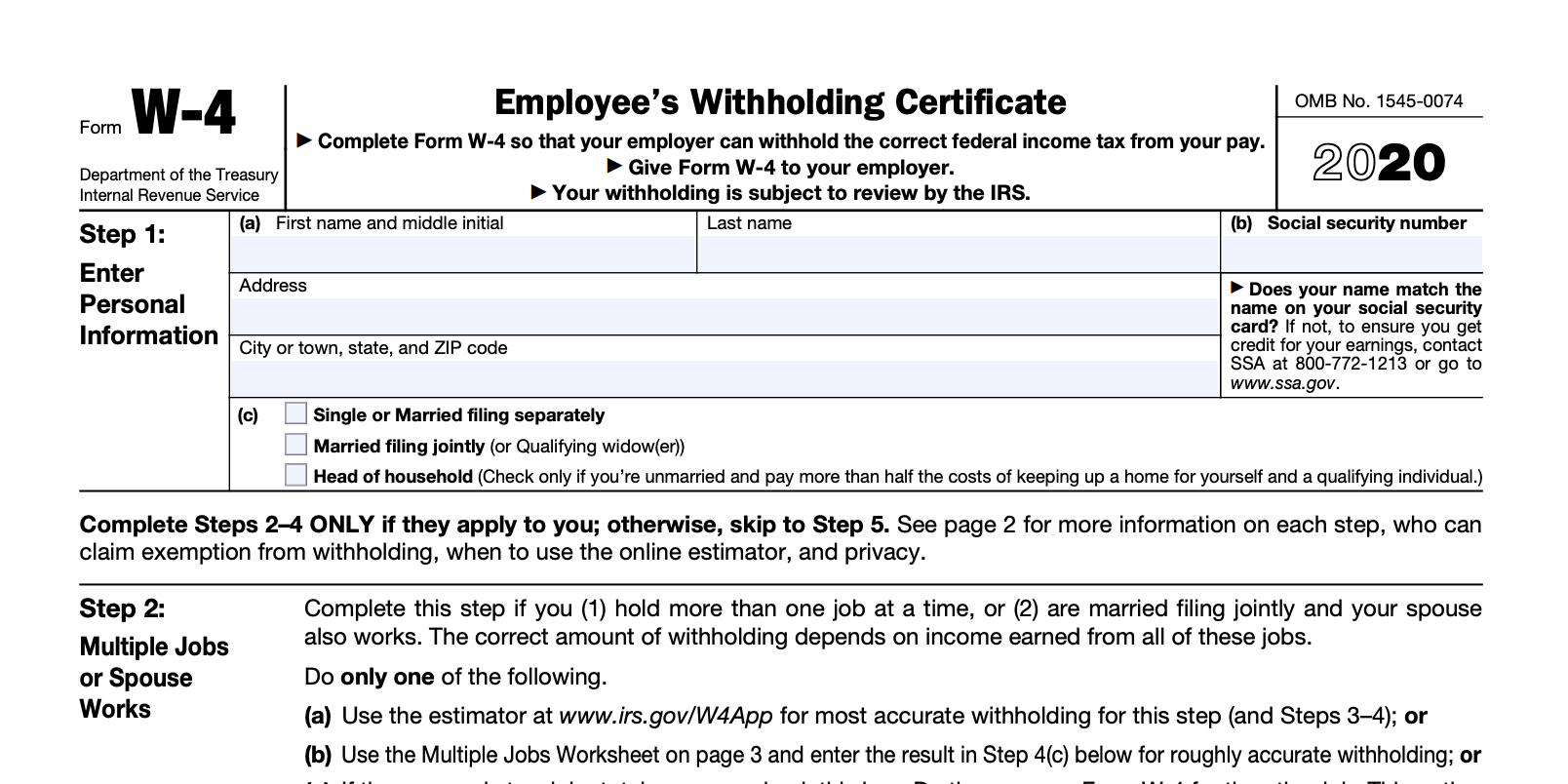

Printable 2020 W4 Form - 2022 W4 Form

Printable 2020 W4 Form - 2022 W4 Form

The first form in our list is the printable 2020 W4 form. This form, depicted in the image above, provides employees with a way to specify their withholding allowances and ensure accurate tax withholdings. By filling out this form correctly, individuals can prevent over or underpayment of taxes throughout the year.

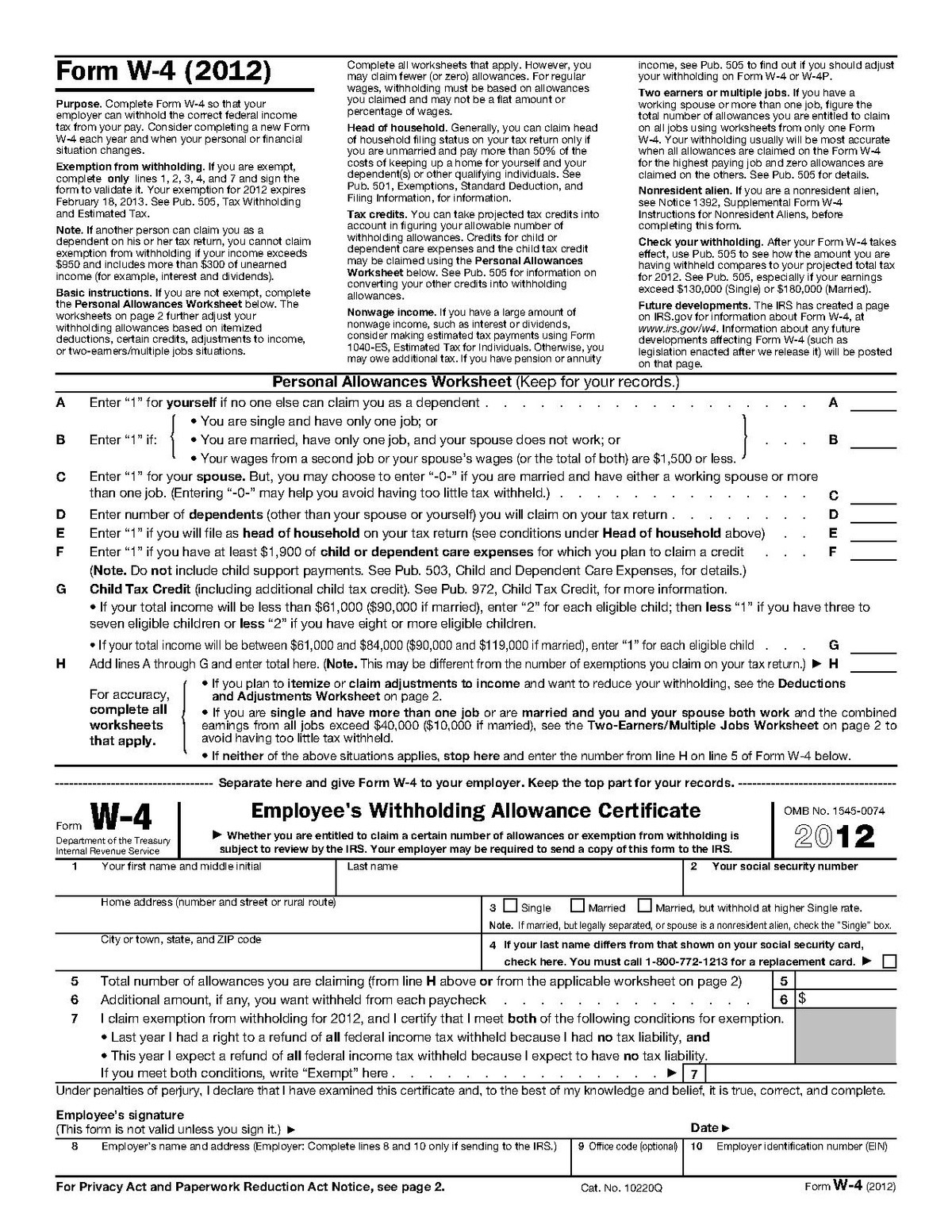

New Form W-4 for 2020 - NMRA

New Form W-4 for 2020 - NMRA

Next up is the new Form W-4 for 2020, as shared by NMRA. This revised version of the W-4 form included substantial changes in comparison to previous years. It aimed to simplify the process of determining tax withholding and align it with the changes brought about by the Tax Cuts and Jobs Act.

W-9 Form 2021 Printable Pdf | Calendar Printables Free Blank

W-9 Form 2021 Printable Pdf | Calendar Printables Free Blank

While the W-4 form deals with employee withholding, the W-9 form pertains to independent contractors and freelancers. The image above showcases a printable version of the W-9 form for the year 2021. This document is crucial for businesses that hire individuals as independent contractors since it helps them gather necessary information for tax reporting purposes.

W4 2020 Form Printable IRS - 2022 W4 Form

W4 2020 Form Printable IRS - 2022 W4 Form

One of the main concerns surrounding the 2020 W-4 form was how it would impact employers. This printable version of the W-4 form, with its clear instructions and guidelines, aimed to address those concerns. Employers could refer to this resource to understand the implications of the updated form and ensure proper compliance.

Wisconsin W4 2020 Form Printable - 2022 W4 Form

Wisconsin W4 2020 Form Printable - 2022 W4 Form

Another important variation of the W-4 form was the Wisconsin-specific printable version as depicted in the image above. Different states may have their own unique forms or requirements, and it is essential for employers and employees to be aware of these distinctions to accurately report their income and withholdings.

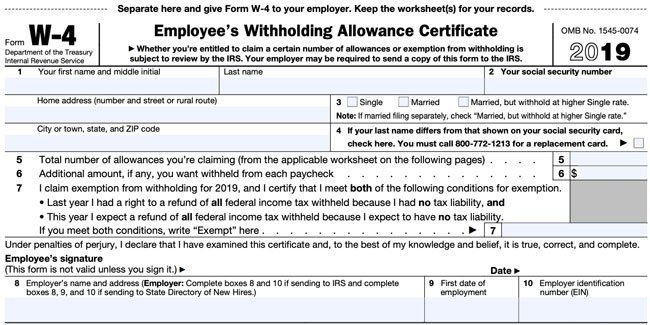

33 best ideas for coloring | Free 2019 W 4 Form Printable

33 best ideas for coloring | Free 2019 W 4 Form Printable

The W-4 form not only serves as a tool for accurate tax reporting but has also inspired creative and artistic interpretations. In the image above, we see an interesting and colorful representation of the W-4 form, highlighting the artistic capabilities of individuals in transforming seemingly mundane documents into intriguing works of art.

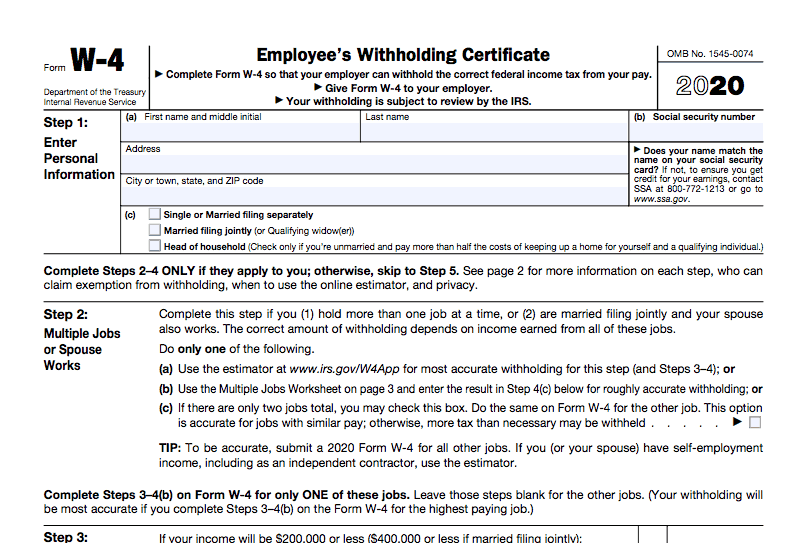

IRS finalizes new W-4 to help taxpayers correct withholding - Don’t

IRS finalizes new W-4 to help taxpayers correct withholding - Don’t

It is imperative for taxpayers to fill out their W-4 forms accurately to avoid any issues with withholding and tax liabilities. The image above shows the finalized version of the W-4 form released by the IRS, which provides clarity and guidance to taxpayers on how to correctly fill out their forms and ensure accurate withholding.

Printable W4 Form

Printable W4 Form

The W-4 form can be perplexing for many individuals, especially those who are filling it out for the first time. However, resources like the printable guide depicted above aim to simplify the process and provide step-by-step instructions for completing the form correctly. By following this guide, taxpayers can ensure accurate withholding and prevent any surprises come tax season.

Irs Form W 4 Printable - Printable Forms Free Online

Irs Form W 4 Printable - Printable Forms Free Online

The IRS form W-4, easily accessible in printable format, is a valuable resource for individuals seeking to understand the tax withholding process. As demonstrated in the image above, this form can be obtained online and provides taxpayers with the necessary information to accurately fill out their W-4 forms and determine the appropriate amount of federal income tax withholding.

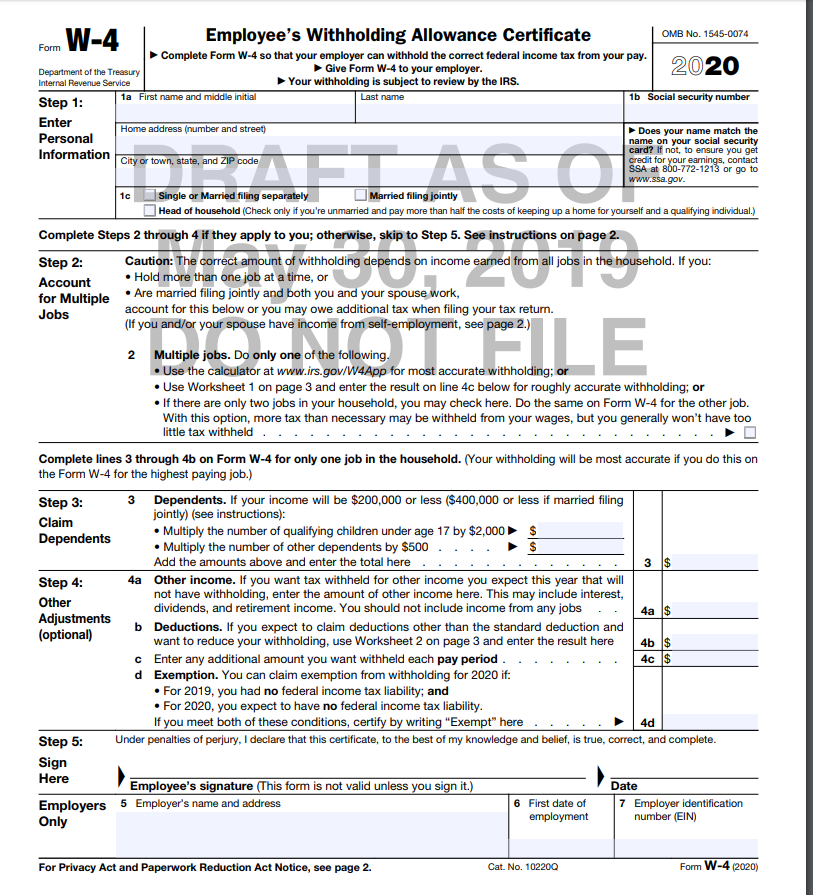

W 4 2020 Form Printable

W 4 2020 Form Printable

The last form in our collection is the IRS draft version of the 2020 W-4 form, displayed in the image above. This form, despite being a draft at the time, gave taxpayers a glimpse into the upcoming changes in tax withholding and allowed them to prepare for its eventual release. It also emphasized the importance of staying up to date with the latest forms and instructions provided by the IRS.

In conclusion, the W-4 form underwent significant changes in 2020, leading to the release of various printable versions. These forms aimed to simplify the process of determining tax withholding for both employees and employers. By adhering to the guidelines provided in these forms, individuals could accurately report their income and ensure proper tax withholding, thereby avoiding any potential issues with the IRS. The availability of printable versions also made it easier for taxpayers to access and fill out the necessary forms, ultimately providing a more streamlined and efficient tax filing experience.