The following are some printable W9 forms that you can use for tax purposes. These forms provide a way for businesses to gather the necessary information from independent contractors and freelancers to report their earnings to the Internal Revenue Service (IRS). It’s important to accurately fill out and submit a W9 form to ensure compliance with tax regulations.

Printable W9 Forms

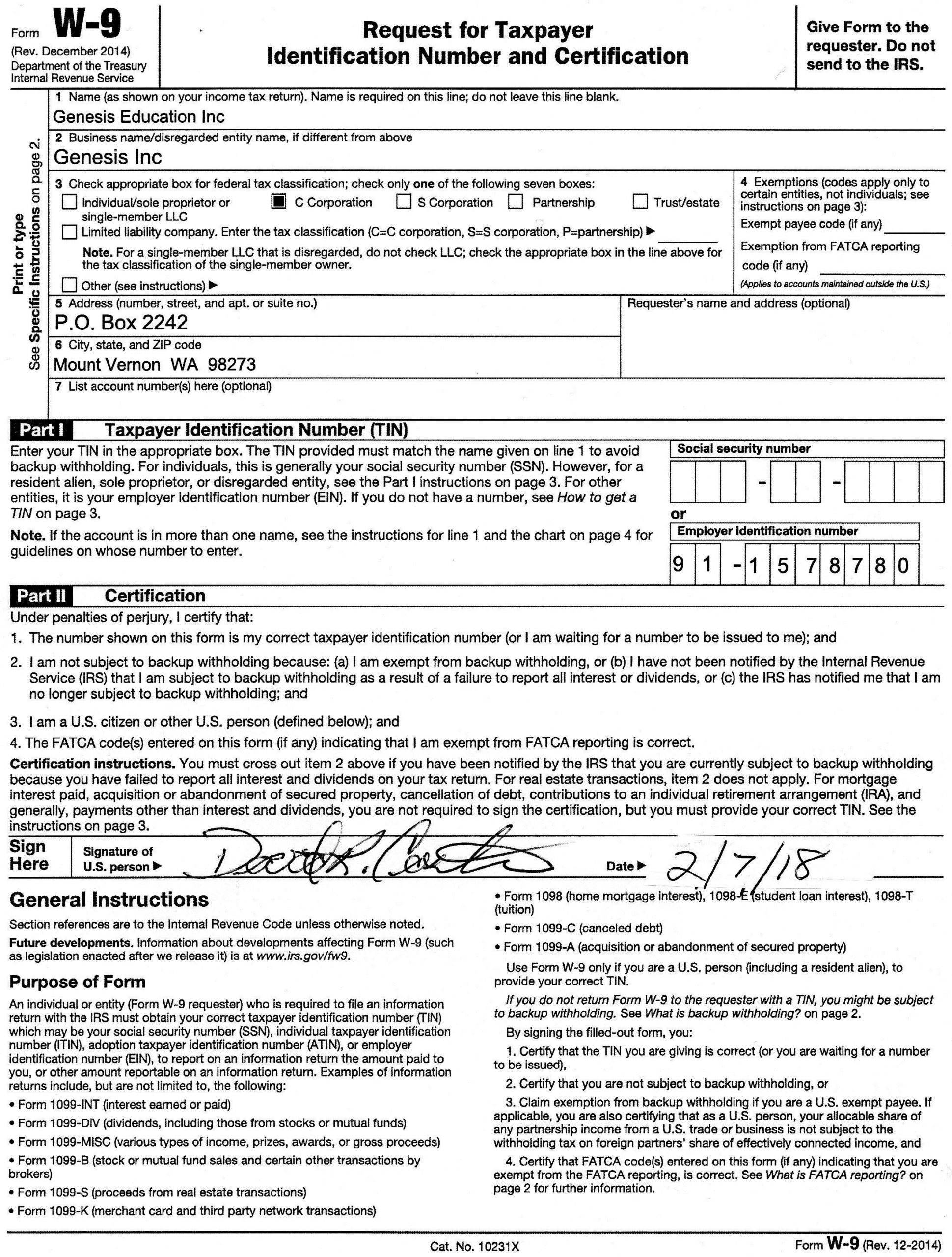

The first printable W9 form is available at this link. It provides a clear and concise layout to help you fill out the necessary information correctly. Remember to include your name, address, and taxpayer identification number.

The first printable W9 form is available at this link. It provides a clear and concise layout to help you fill out the necessary information correctly. Remember to include your name, address, and taxpayer identification number.

W9 Forms 2021 Printable | W9 Tax Form 2021

If you are looking for a 2021 version of the W9 form, you can find one here. This form includes all the necessary fields to provide accurate information to the IRS.

If you are looking for a 2021 version of the W9 form, you can find one here. This form includes all the necessary fields to provide accurate information to the IRS.

IRS W9 Form 2021 Printable - W9 Form 2021 Printable

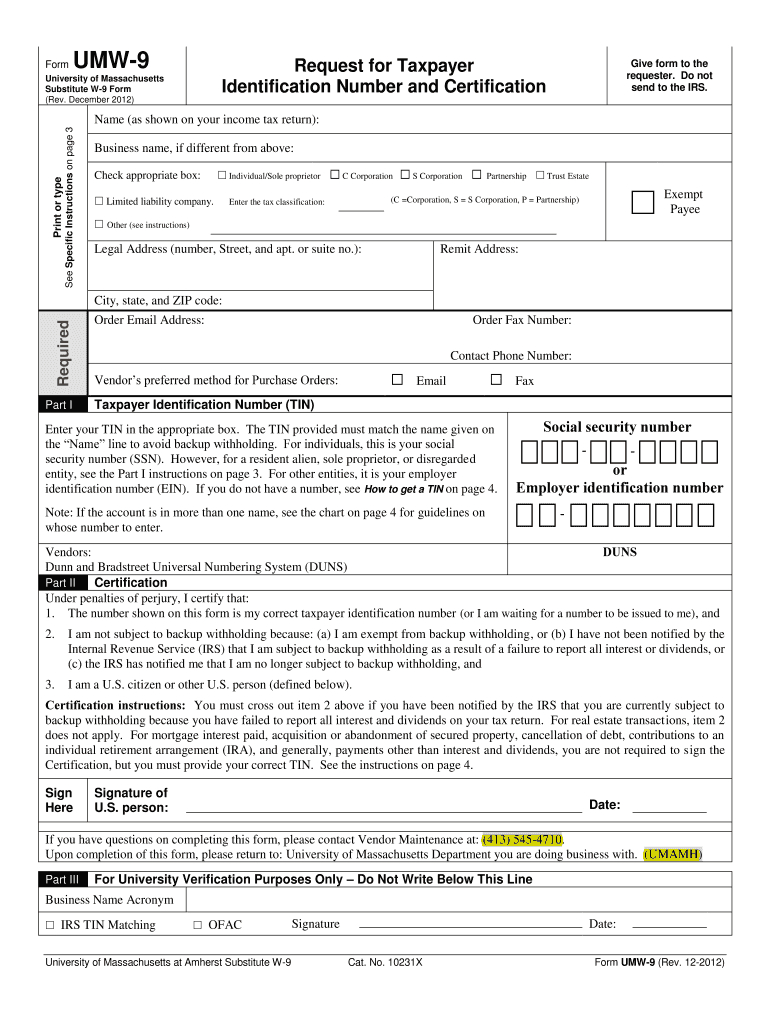

Another option for a printable W9 form for 2021 is available at this site. This form is designed to align with the requirements set by the IRS, ensuring accurate reporting of income.

Another option for a printable W9 form for 2021 is available at this site. This form is designed to align with the requirements set by the IRS, ensuring accurate reporting of income.

W9 Forms 2021 Printable Pdf | Example Calendar Printable

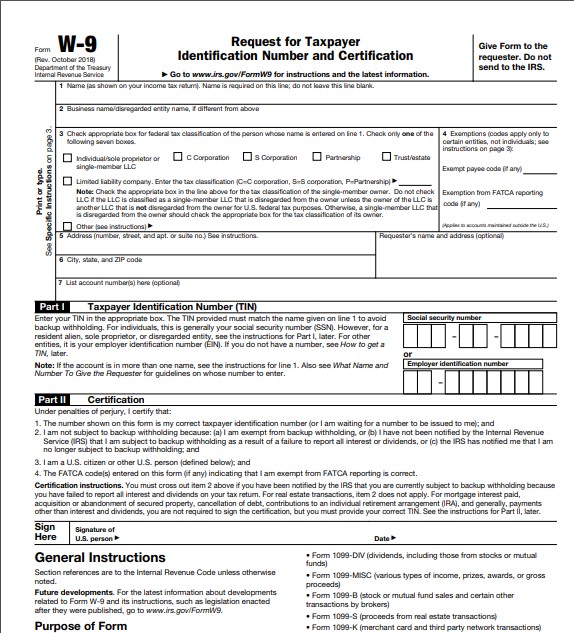

For those who prefer a PDF format, you can find a printable W9 form for 2021 in PDF at this link. The PDF form is easy to fill out and sign electronically.

For those who prefer a PDF format, you can find a printable W9 form for 2021 in PDF at this link. The PDF form is easy to fill out and sign electronically.

IRS W9 Form 2021 Printable - W9 Form 2021 Printable

If you are in need of another option for a printable W9 form, you can visit this website. The form provided here meets IRS requirements and allows for accurate reporting of income.

If you are in need of another option for a printable W9 form, you can visit this website. The form provided here meets IRS requirements and allows for accurate reporting of income.

These are just a few examples of printable W9 forms available for use. It’s important to choose the form that best suits your needs and provides all the necessary fields for accurate reporting. Remember to fill out the form completely and provide all requested information. Failure to do so may result in fines or penalties from the IRS. It’s always a good idea to consult with a tax professional if you have any questions about filling out the W9 form or your tax obligations.

For more information on tax forms and requirements, you can visit the IRS website or consult with a tax advisor. Take the time to ensure that you are accurately reporting your income and fulfilling your tax obligations as a responsible taxpayer.