How To Obtain A W2 From A Former Employer - Ethel Hernandez’s Templates

How to Request Your W2 from a Previous Employer

Are you in need of your W2 form from a previous employer? Ethel Hernandez’s Templates has got you covered! We understand the hassle of finding and obtaining these important documents, which is why we have created a simple guide to help you navigate the process. Whether you need your W2 for tax purposes or to complete other financial transactions, follow these steps to obtain your W2 form easily.

Are you in need of your W2 form from a previous employer? Ethel Hernandez’s Templates has got you covered! We understand the hassle of finding and obtaining these important documents, which is why we have created a simple guide to help you navigate the process. Whether you need your W2 for tax purposes or to complete other financial transactions, follow these steps to obtain your W2 form easily.

Step 1: Contact Your Previous Employer

The first step in obtaining your W2 form is reaching out to your former employer. You can do this by email, phone, or through their HR department. Be sure to provide them with your contact information and any relevant details, such as the years for which you need the W2. It’s essential to provide accurate information to avoid any delays in receiving your form.

The first step in obtaining your W2 form is reaching out to your former employer. You can do this by email, phone, or through their HR department. Be sure to provide them with your contact information and any relevant details, such as the years for which you need the W2. It’s essential to provide accurate information to avoid any delays in receiving your form.

Step 2: Verify Your Identity

Once you have contacted your previous employer, they may require you to verify your identity before releasing your W2 form. This is a standard security measure to ensure that the information is being provided to the correct person. You may need to provide identification documents or answer specific questions related to your employment with the company.

Once you have contacted your previous employer, they may require you to verify your identity before releasing your W2 form. This is a standard security measure to ensure that the information is being provided to the correct person. You may need to provide identification documents or answer specific questions related to your employment with the company.

Step 3: Request a Duplicate W2 Form

If your previous employer is unable to provide you with a copy of your W2 form, you can request a duplicate W2 from the Internal Revenue Service (IRS). The IRS keeps records of all W2 forms submitted by employers. You can request a transcript or a full copy of your W2 form by filling out Form 4506-T, which is available on the IRS website. Be prepared to provide your personal information and the years for which you are requesting the duplicate W2 form.

If your previous employer is unable to provide you with a copy of your W2 form, you can request a duplicate W2 from the Internal Revenue Service (IRS). The IRS keeps records of all W2 forms submitted by employers. You can request a transcript or a full copy of your W2 form by filling out Form 4506-T, which is available on the IRS website. Be prepared to provide your personal information and the years for which you are requesting the duplicate W2 form.

Step 4: Fill Out the W2 Form

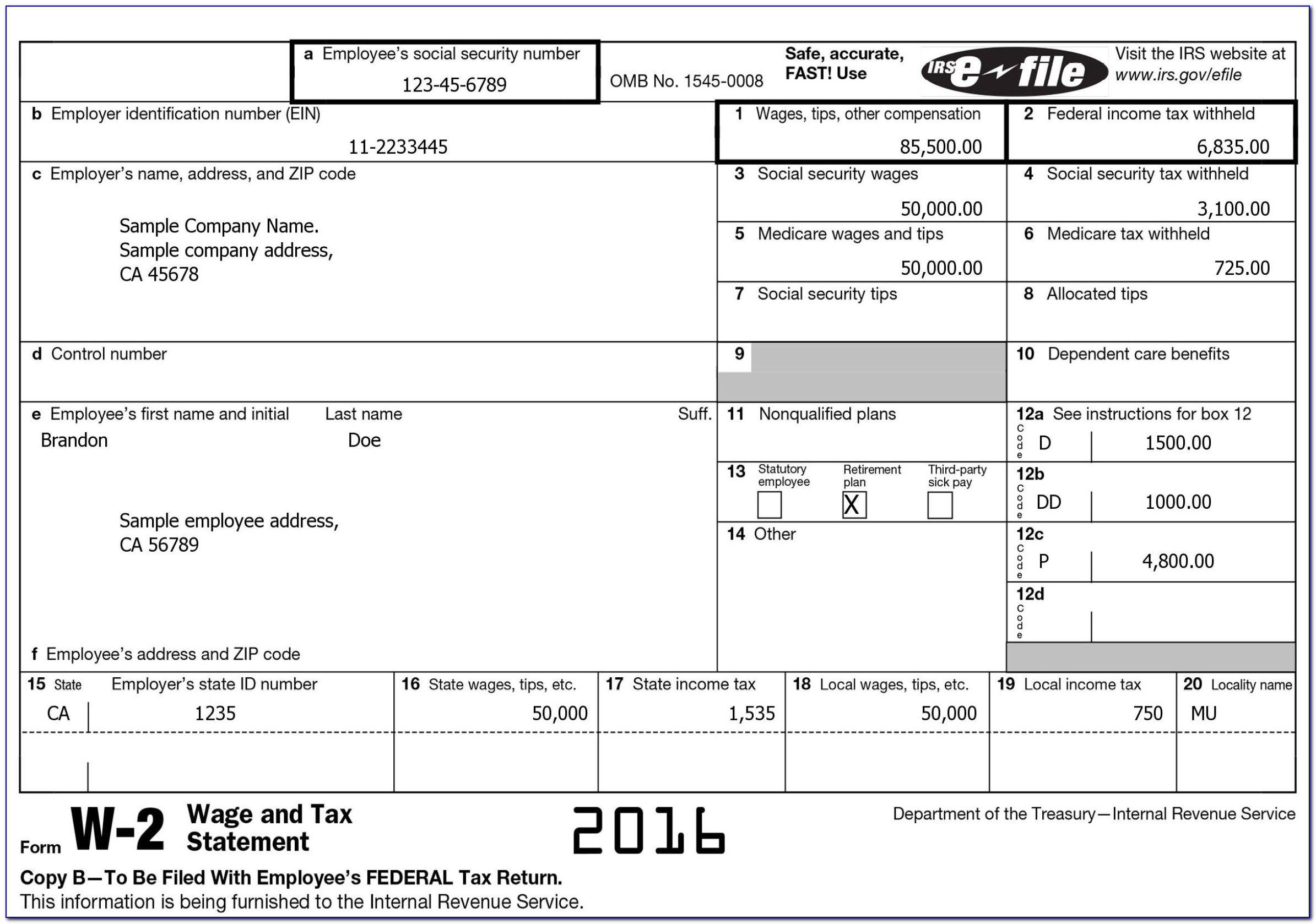

If you have obtained a blank W2 form, either from your previous employer or the IRS, you will need to fill it out accurately. The W2 form includes various sections where you need to enter your personal information, including your name, Social Security number, and address. Additionally, you will need to provide details about your previous employer, such as their name, address, and employer identification number (EIN). Take your time to ensure all information is correct, as any errors could lead to complications when filing your taxes.

If you have obtained a blank W2 form, either from your previous employer or the IRS, you will need to fill it out accurately. The W2 form includes various sections where you need to enter your personal information, including your name, Social Security number, and address. Additionally, you will need to provide details about your previous employer, such as their name, address, and employer identification number (EIN). Take your time to ensure all information is correct, as any errors could lead to complications when filing your taxes.

Step 5: Understand Your W2 Form

Before using your W2 form for tax purposes, it’s essential to understand the information it contains. The W2 form provides details about your earnings, taxes withheld, and any other deductions or contributions made throughout the year. Familiarize yourself with the different boxes on the form and what they represent. This understanding will help you accurately report your income and claim any applicable deductions or credits when filing your taxes.

Before using your W2 form for tax purposes, it’s essential to understand the information it contains. The W2 form provides details about your earnings, taxes withheld, and any other deductions or contributions made throughout the year. Familiarize yourself with the different boxes on the form and what they represent. This understanding will help you accurately report your income and claim any applicable deductions or credits when filing your taxes.

Step 6: Keep a Record of Your W2 Form

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png) Once you have obtained your W2 form, it’s crucial to keep a record of it for your records. This will ensure that you have the necessary documentation in case of any future inquiries or audits. Store your W2 form in a safe and easily accessible place, along with other important tax documents, such as receipts and financial statements.

Once you have obtained your W2 form, it’s crucial to keep a record of it for your records. This will ensure that you have the necessary documentation in case of any future inquiries or audits. Store your W2 form in a safe and easily accessible place, along with other important tax documents, such as receipts and financial statements.

Step 7: Seek Professional Assistance (if needed)

If you find the process of obtaining your W2 form overwhelming or have any questions related to your taxes, it’s always beneficial to seek professional assistance. Tax professionals, such as accountants or tax preparers, can provide expert guidance and ensure that you are accurately filing your taxes. They can answer any questions you may have and help you navigate through any complexities that may arise.

If you find the process of obtaining your W2 form overwhelming or have any questions related to your taxes, it’s always beneficial to seek professional assistance. Tax professionals, such as accountants or tax preparers, can provide expert guidance and ensure that you are accurately filing your taxes. They can answer any questions you may have and help you navigate through any complexities that may arise.

Conclusion

Obtaining your W2 form from a former employer may seem like a daunting task, but with these steps, you can make the process much smoother. Remember to reach out to your previous employer, verify your identity, and request a duplicate W2 form if needed. Take the time to fill out the form accurately and understand its contents. Keep a record of your W2 form for future reference, and seek professional assistance if you require any further guidance. With these guidelines, you’ll have your W2 form in hand and be ready to tackle your tax obligations with ease!

Obtaining your W2 form from a former employer may seem like a daunting task, but with these steps, you can make the process much smoother. Remember to reach out to your previous employer, verify your identity, and request a duplicate W2 form if needed. Take the time to fill out the form accurately and understand its contents. Keep a record of your W2 form for future reference, and seek professional assistance if you require any further guidance. With these guidelines, you’ll have your W2 form in hand and be ready to tackle your tax obligations with ease!