Asian people are known for their diligent work ethic and dedication to their jobs, ensuring that they fulfill all their responsibilities. One important aspect of being an employee is understanding and filling out tax forms correctly. In this post, we will explore various resources and forms related to taxes, specifically focusing on the W4 form for the year 2021-2022.

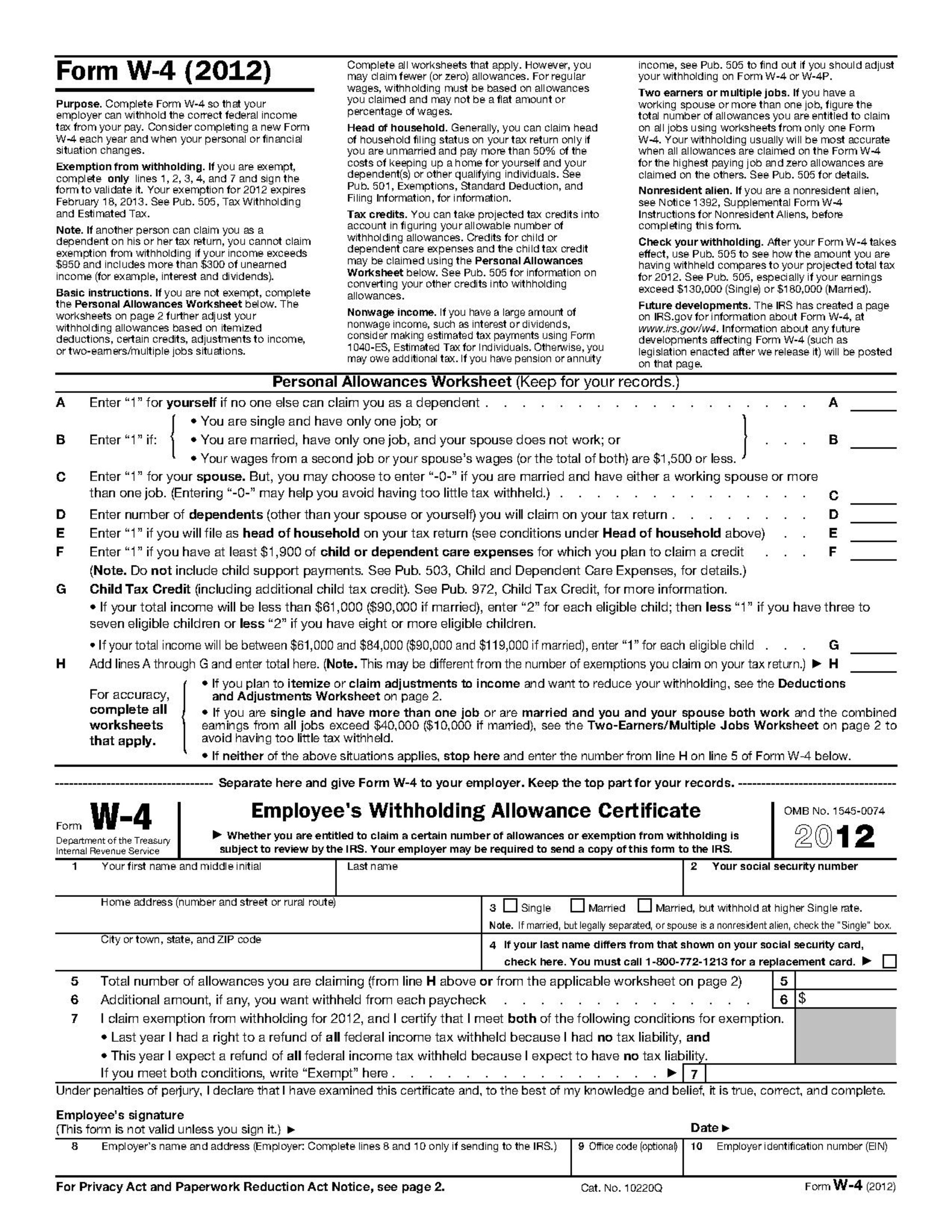

Michigan W 4 2021 - 2022 W4 Form

One of the essential tax forms for employees is the W4 form. The Michigan W4 form for the year 2021-2022 provides employees with the opportunity to declare their withholding allowances and ensure accurate tax deductions from their paychecks. By completing this form correctly, employees can have a clear understanding of their tax obligations and ensure that they are paying the right amount of taxes throughout the year. It is crucial that employees fill out this form accurately to avoid any discrepancies or penalties when filing their taxes.

Source: w4formsprintable.com

Source: w4formsprintable.com

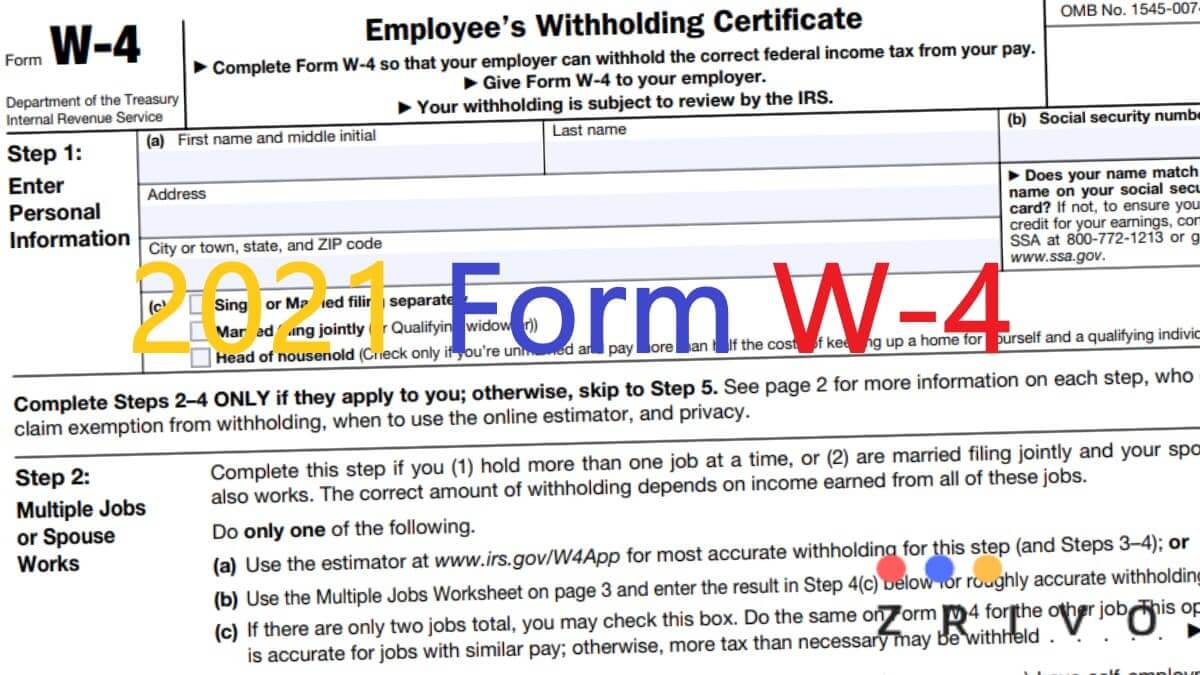

2021 Federal Tax Forms For Employees - 2022 W4 Form

Another significant tax form for employees is the federal W4 form for the year 2021-2022. This form is used to determine the federal income tax that needs to be withheld from an employee’s paycheck. It is crucial to complete this form accurately, considering factors such as filing status, dependents, and additional income. By doing so, employees can ensure that the correct amount of taxes is deducted from their earnings, preventing any surprises or underpayment when it comes time to file their taxes.

Source: w4formsprintable.com

Source: w4formsprintable.com

Blank W4 Form 2021 - 2022 W4 Form

For employees who prefer to fill out their W4 forms manually, having access to a blank W4 form for the year 2021-2022 is essential. This form allows individuals to input their personal information, filing status, and withholding allowances accurately. By using a blank form, employees can fill in the required details according to their specific circumstances, ensuring that their tax deductions align with their financial situation.

Source: w4formsprintable.com

Source: w4formsprintable.com

Form W-4 2021 Printable - 2022 W4 Form

For employees looking for a printable version of the W4 form for the year 2021-2022, a downloadable and printable version is available. This allows employees to conveniently print the form, fill in their details, and retain a copy for their records. Having a printable version of the W4 form ensures accessibility and ease when it comes time to complete and submit this essential tax document.

Source: w4formsprintable.com

Source: w4formsprintable.com

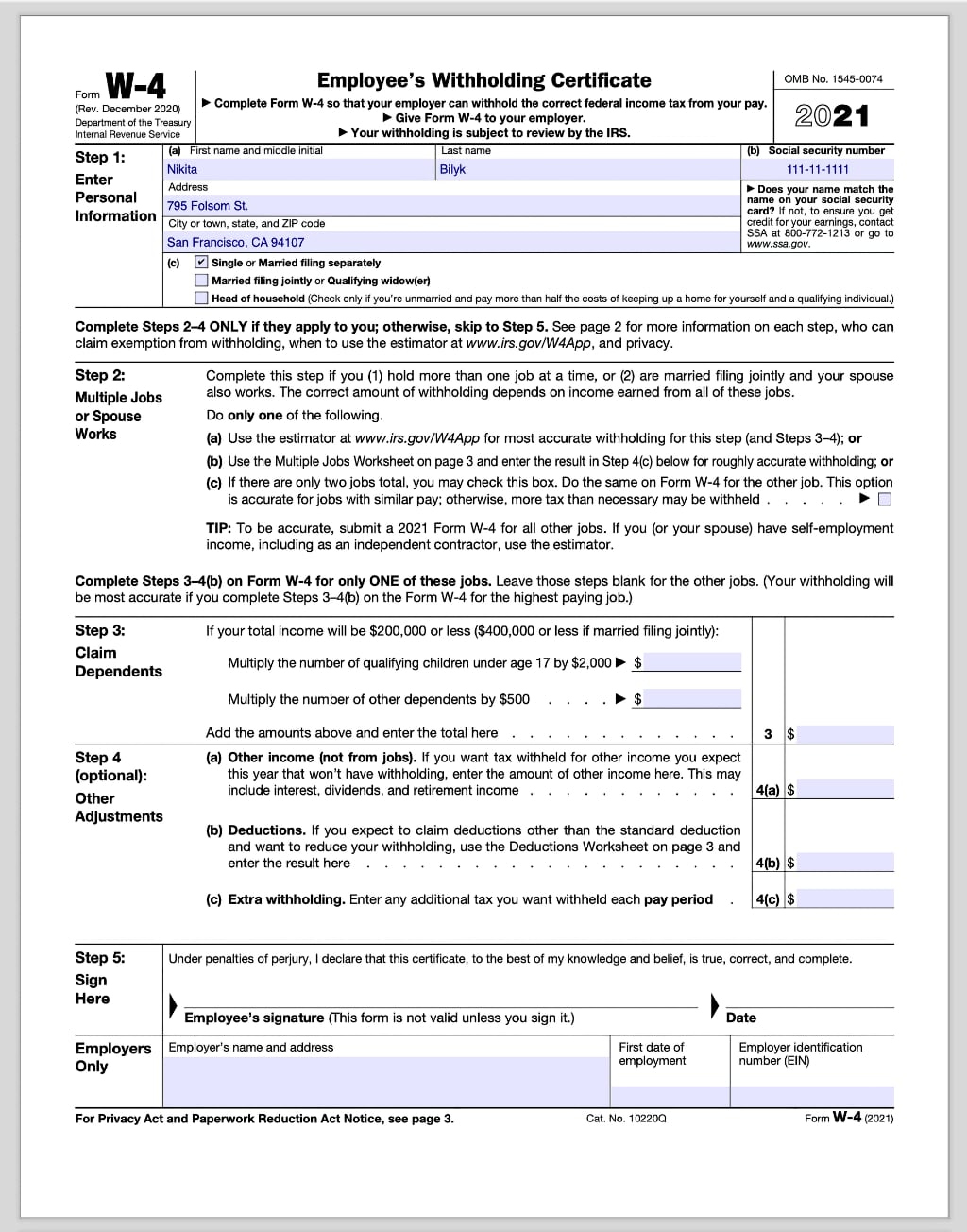

Sample W4 2021 Filled Out Sample W4 2021 Filled Out - The W4 Form 2021

If you’re unsure how to fill out the W4 form correctly, referring to a filled-out sample can be incredibly helpful. This sample W4 form for the year 2021 provides employees with a visual representation of how to complete the form accurately. It outlines the various sections and provides an example of how personal information, such as filing status and allowances, should be filled out. By having a sample as a reference, employees can ensure that they are providing the necessary information and avoiding any errors or omissions on their W4 form.

Source: i.pinimg.com

Source: i.pinimg.com

State Of Illinois W4 Form 2021 - 2022 W4 Form

Employees residing in the state of Illinois have a specific W4 form catering to their state tax regulations. The State of Illinois W4 form for the year 2021-2022 allows employees to declare their state income tax withholding allowances accurately. It is essential for employees in Illinois to complete this form correctly to ensure compliance with state tax requirements and avoid any penalties or issues when filing their taxes.

Source: w4formsprintable.com

Source: w4formsprintable.com

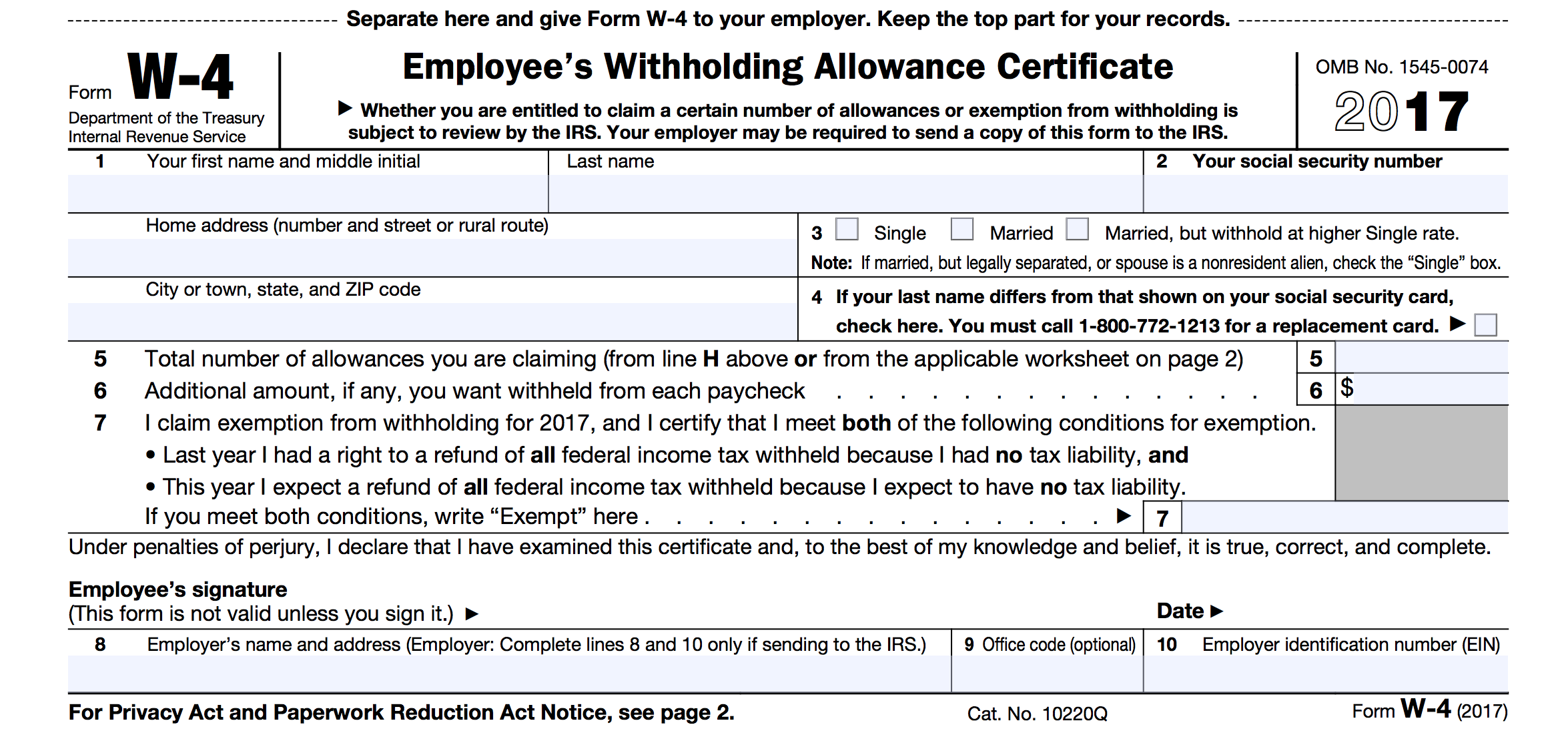

W4 Form 2021

The W4 form for the year 2021 is a vital document that all employees must complete. It allows individuals to specify their withholding allowances accurately, ensuring that the correct amount of federal income tax is deducted from their paychecks. By correctly filling out the W4 form, employees can proactively manage their tax obligations and avoid any surprises or discrepancies when filing their taxes.

Source: zrivo.com

Source: zrivo.com

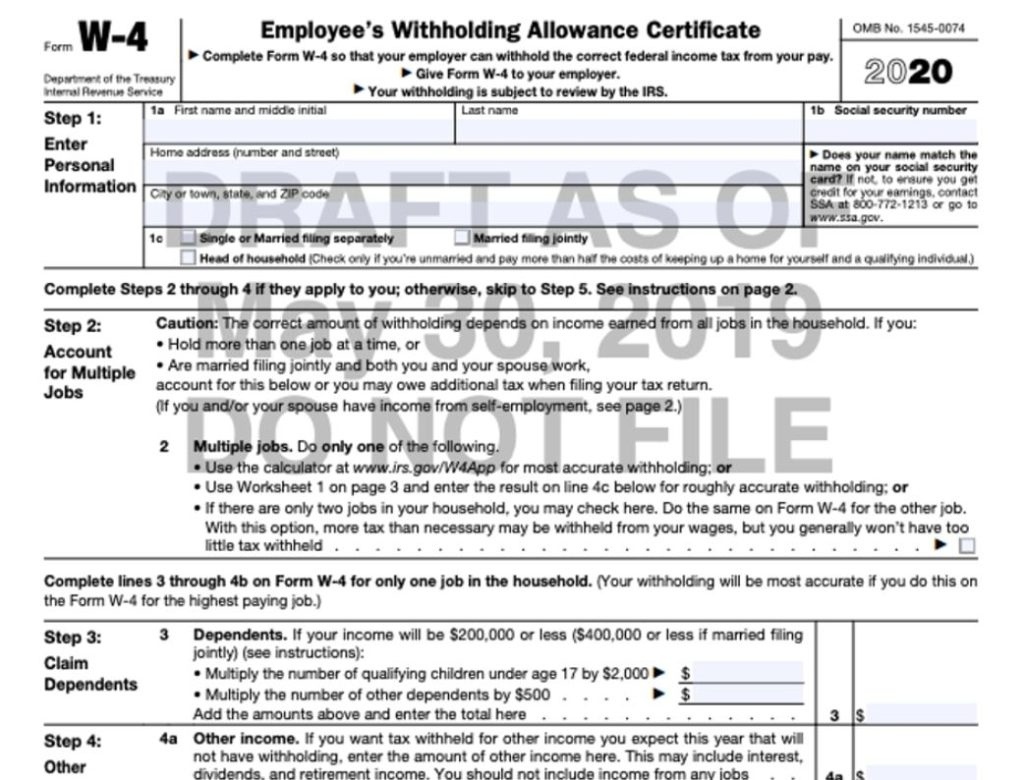

Blank W 4 Form 2021 Printable - 2022 W4 Form

For employees who prefer a printable, blank version of the W4 form for the year 2021-2022, a downloadable template is available. This form allows individuals to input their personal information, filing status, and withholding allowances accurately. By using a printable template, employees can easily fill in the required details and have a record of their completed W4 form for their own reference.

Source: w4formsprintable.com

Source: w4formsprintable.com

Fillable 2021 W4 - Fill and Sign Printable Template Online | US Legal Forms

If you prefer a digital alternative to traditional paper forms, fillable and signable W4 forms are available. Various online platforms, such as US Legal Forms, offer fillable templates that allow employees to input their information digitally. This provides convenience and ease when completing the W4 form, as individuals can type directly into the form instead of handwriting their details. Once completed, the form can be signed digitally, eliminating the need for printing and physically mailing the document.

Source: pdffiller.com

Source: pdffiller.com

Employee Tax Form W 4 - 2022 W4 Form

Completing the employee tax form W4 accurately is crucial for all individuals. This form determines the amount of federal income tax that employers withhold from employees’ paychecks. By understanding the requirements of the W4 form and filling it out correctly, employees can ensure that the right amount of taxes is being deducted from their earnings. It is important for employees to review their W4 form annually and make any necessary updates to reflect changes in their financial or personal circumstances.

Source: w4formsprintable.com

Source: w4formsprintable.com

Understanding and correctly completing tax forms, such as the W4 form, is essential for all employees. By ensuring accurate withholding allowances, individuals can avoid the risk of owing additional taxes or receiving a smaller tax refund. Whether utilizing printable forms, sample references, or fillable templates, employees have various resources available to assist them in accurately completing the necessary tax documents. By taking the time to understand and complete the required tax forms correctly, individuals can ensure a smooth tax filing process and fulfill their tax obligations diligently.